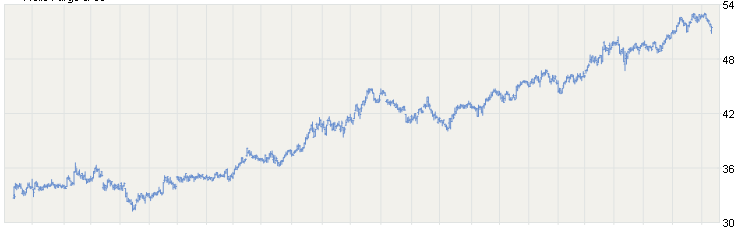

The last two years have been great for Wells Fargo stockholders. In 2012, the value of a share was just around $23. The stock high has been around $53 on July 3. However, the ride may be rough over the next few months.

On Friday, Wells Fargo & Co posted an increase in net income of 3.8%, but its shares were down 0.7% as a key lending profitability measure declined and the cost-cutting programs at the bank stalled.

Wells Fargo announced $5.73 billion in net income, compared to $5.52 billion from the same period one year ago. Earnings per share, which reflected the payment of its preferred dividends, were at $1.01, compared to 98 cents during the same reporting period one year ago.

Revenue slid by 1.5% to end the quarter at $21.07 billion. Analysts were expecting $1.01 earnings per share on revenue just over $20.84 billion.

While the analysts cut estimates for rival banks recently, the estimates made for Wells Fargo remained steady. Never a firm that is big on trading, Wells Fargo focused on revenue generation from its consumer and commercial lending as its rivals pulled further from some of those types of business following the financial crisis.